Invoice Scanning Software for UK Businesses

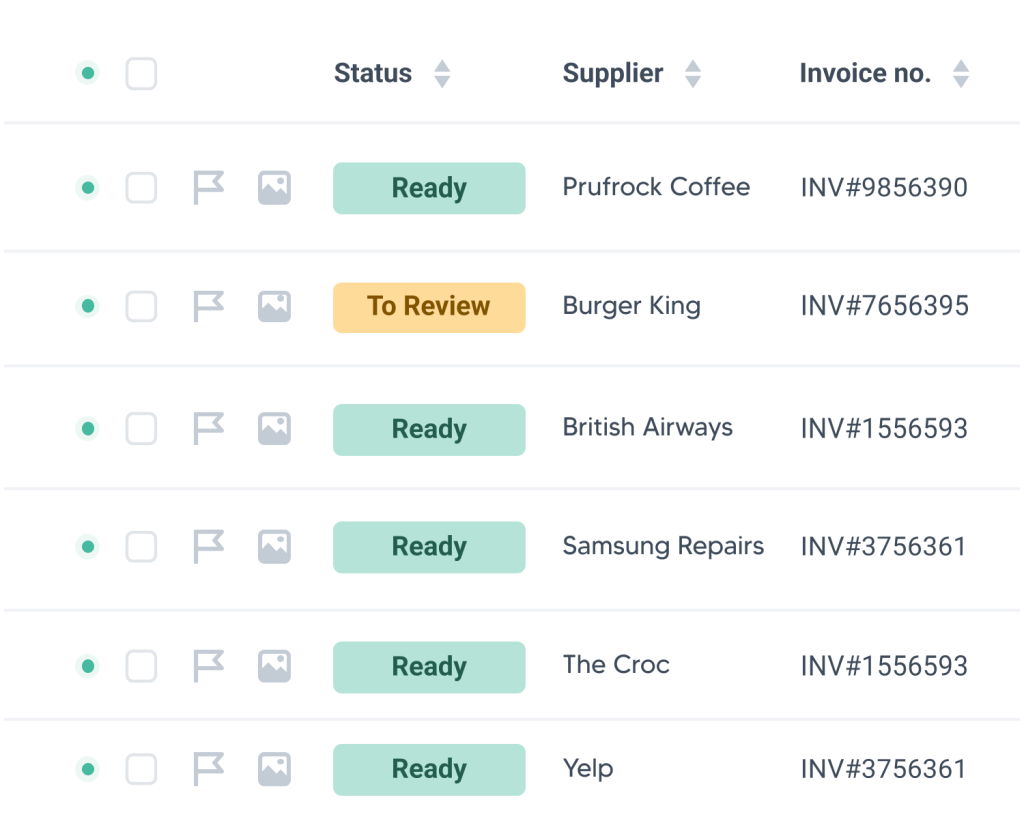

EazyCapture uses Neural Document Understanding to extract line-items with accuracy for UK SMEs and Accountants.

Fully MTD Compliant • Integrates with Xero & QuickBooks

Why Hand-Entered Invoice Processing is Costing You Thousands?

The average UK business has to pay a lot of time and resources for individual invoice processing every time.

Operational Drain

Staff spending 20+ hours a week re-keying data instead of focusing on high-value financial advisory.

Human Error Risk

Typing errors lead to duplicate payments and VAT miscalculations that trigger HMRC audits.

Lost Audit Trails

Missing paper receipts and unsearchable PDFs make year-end accounting a nightmare for bookkeepers.

Smart Automation Will Make it Easier For Your Business To Adapt in the UK

As HMRC continues to roll out the Making Tax Digital (MTD) initiative, the pressure on UK SMEs to maintain accurate, real-time digital records has never been higher.

Transitioning from legacy paper-based systems to a digital-first workflow isn’t just about compliance; it’s about business survival in an increasingly competitive market. Traditional bookkeeping is plagued by delayed visibility and manual bottlenecks that prevent business owners from understanding their true cash flow.

EazyCapture bridges the gap between physical receipts and digital ledgers. By implementing high-speed invoice scanning software, UK businesses can ensure that every transaction (from a simple petrol receipt to a complex sub-contractor invoice) is captured, categorised, and pushed to the cloud instantly. This automated approach eliminates the “shoebox accounting” phenomenon, providing accountants and finance teams with a clean, verifiable audit trail that meets the strictest HMRC requirements for digital record-keeping.

AI-Powered Extraction That "Reads" Like a Human

Smart Line-Item Splitting

Automatically detects and separates 0%, 5%, and 20% VAT lines from complex invoices.

Handwritten Recognition

Reads scribbled notes, manual corrections, and handwriting on "shoebox" receipts with ease.

Bulk Multi-Page PDF Handling

Upload a single 100-page PDF containing 50 different invoices; our AI splits them instantly.

Why Neural Document Extraction Beats Traditional OCR

Many businesses are frustrated with traditional Optical Character Recognition (OCR) because it often fails to understand the structure of a document.

Basic OCR simply turns images into text, leaving the user to manually map “Total” to the right field. EazyCapture utilizes advanced Neural Document Understanding, which goes beyond mere character recognition to perform semantic analysis.

Our system recognizes patterns, context, and intent. For example, it can distinguish between a supplier’s VAT number and their phone number even if they are positioned similarly on the page.

In the context of UK VAT, our AI understands the difference between standard-rated, zero-rated, and exempt items, automatically calculating the expected tax and flagging discrepancies.

This level of technical sophistication reduces the “validation time” for finance teams, allowing for a truly “touchless” accounts payable process.

This was previously only available to enterprise-level corporations.

Tailored For Every Industry

Accounting Firms

Construction (CIS)

Retail & E-commerce

Healthcare Providers

Restaurants

Professional Services

Stay HMRC Compliant Effortlessly

EazyCapture is built specifically for UK VAT legislation. We validate supplier VAT numbers, verify calculations, and maintain a 7-year digital archive – ensuring your business is fully MTD ready.

- Every transaction is linked to its original image.

- Automated handling of Construction Industry Scheme deductions.

HMRC-Ready Security

Minimal Data Exposure

No unnecessary data duplication, controlled processing, secure transient handling.

UK Data Sovereignty

GDPR-compliant processing with primary storage within the UK/EEA.

AES-256 Encryption

Bank-grade encryption for all financial documents at rest and in transit.

Simple, Transparent Pricing

It’s not all about price. It’s about who actually solves the problem, and EazyCapture does it better.

Eazy Start

GBP, Excludes Tax, Monthly subscription, billed monthly

Minimum Clients: 10

Example (50 clients):

Total: £348.00 per month

Incl. VAT: £417.60

Eazy Scale

GBP, Excludes Tax, Monthly subscription, billed monthly

Minimum Clients: 10

Example (50 clients):

Total: £599.50 per month

Incl. VAT: £719.40

More Than 500 Clients?

Explore Our Custom Enterprise Plan

| Features | Eazy Start | Eazy Scale |

|---|---|---|

| Transition Support from Existing Stack | ✔ | ✔ |

| Team Support to Ask Technical Queries | ✔ | ✔ |

| Mobile Application | ✔ | ✔ |

| Capture Purchases & Sales Invoices | ✔ | ✔ |

| Capture Multiple Invoices in a Single Photo | ✔ | ✔ |

| Capture Multi-Page PDF of Invoices | – | Up to 100 pages PDF |

| Multi-Currency Invoice Conversion | – | ✔ |

| Asset Categorisation | ✔ | ✔ |

| Detect Prepayments | ✔ | ✔ |

| Multilingual Support | ✔ | ✔ |

| Line Item Extraction | – | ✔ |

| Correct VAT Rate Extraction | ✔ | ✔ |

| Smart Query Management | ✔ | ✔ |

Handling the "Shoebox" Client

Established tools often struggle with the marginal notes that small business owners write on their receipts. EazyCapture's vision models are trained to prioritize these annotations.

- Captures handwritten totals, dates, and account codes.

- Differentiates between printed text & manual corrections.

“We use EazyCapture specifically for our hospitality clients where handwritten ‘cash-paid’ notes on invoices used to require hours of manual journal adjustments.”

– Senior Accountant, London

Discover Everything About EazyCapture

EazyCapture is an invoice capture tool that reads, understands, and categorises invoices. It applies industry rules, validates VAT, and posts directly into accounting software with audit-ready accuracy.

The system is trained on UK VAT legislation. It validates VAT numbers, checks calculations, splits multi-rate line items, and ensures all records meet HMRC’s Making Tax Digital (MTD) requirements.

Yes. You can upload bulk PDFs, multipage files, or even photos containing several invoices. EazyCapture detects and processes each invoice individually with correct categorisation.

EazyCapture integrates seamlessly with Xero and QuickBooks. Sage and FreeAgent integrations are also coming soon. Entries are posted directly into your ledger with the right categories, VAT treatment, and supporting documents attached.

Unlike standard OCR, EazyCapture learns from up to 24 months of past data, applies accountant-level rules, and understands context, ensuring consistent and precise categorisation across all invoices.

Yes. The system detects prepayments such as insurance or rent, and classifies assets correctly based on business type (tangible or intangible), without manual intervention.

Absolutely. EazyCapture supports multiple currencies, converting amounts using live exchange rates while retaining original values, making it ideal for businesses with international suppliers.

Yes, all data is encrypted at rest and in transit, stored on secure UK servers, and never shared between clients.

Try EazyCapture’s 30-Day Free Trial

Equip your business with a pre-bookkeeping assistant that thinks like your practice and works as you would.

Click on Early Access to gain free access to the beta version.