For many small business owners in the UK, the working day does not end when the shop closes or the last client leaves.

It ends several hours later, usually at a kitchen table, surrounded by a mountain of crumpled thermal receipts, printed invoices, and open email tabs.

This is the “admin trap,” a cycle of manual data entry that drains the energy and resources of the most vital sector of the British economy.

While the term “invoice scanner” might sound like a simple piece of hardware from the 1990s, the modern reality is far more sophisticated.

Today, an invoice scanner is a digital gateway to an automated bookkeeping assistant. It is the difference between surviving your paperwork and mastering your finances.

In this guide, we explore why this technology is no longer optional for small businesses, backed by the latest UK financial data and regulatory requirements.

The Real Cost of "Doing It Yourself"

One of the most persistent myths in the small business world is that manual data entry is “free” because the business owner is doing it themselves.

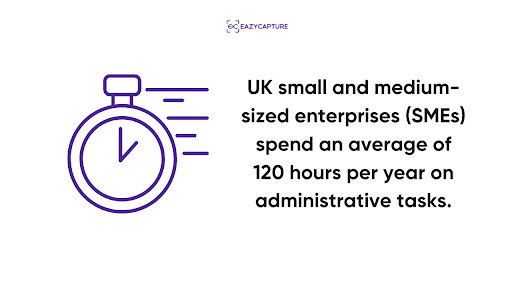

However, the data suggests a much darker reality. According to research from Sage, UK small and medium-sized enterprises (SMEs) spend an average of 120 hours per year on administrative tasks. Crucially, more than 20% of that time is dedicated solely to accounting administration.

If you value your time at a modest £25 per hour, those 120 hours represent a hidden cost of £3,000 per year.

But the financial impact goes deeper than just lost time. Industry benchmarks from Gartner indicate that the cost of manually processing a single invoice in the UK ranges from £4 to as much as £25 when you account for labour, error correction, and storage.

When a business uses a professional bookkeeping assistant like EazyCapture, these costs are slashed by 60% to 80%. By automating the extraction of supplier names, VAT numbers, dates, and totals, the cost per invoice drops to pennies. For a business processing 50 invoices a month, this switch doesn’t just save time; it fundamentally changes the profitability of the operation.

Understanding the MTD and HMRC Compliance

The UK’s tax landscape is undergoing its most significant shift in a generation. HM Revenue & Customs (HMRC) is steadily rolling out Making Tax Digital (MTD), with the next major milestone for Income Tax Self Assessment (ITSA) in April 2026.

For any business owner or landlord with a qualifying income over £50,000, digital record-keeping will move from being a “good idea” to a legal requirement.

HMRC’s latest “Tax Gap” report, published in mid-2025, estimated the gap between tax due and tax collected at £46.8 billion. Small businesses are responsible for a staggering 60% of this gap. Interestingly, the majority of this isn’t due to intentional evasion. HMRC attributes 31% of the gap to a “failure to take reasonable care” and 15% to simple “error.”

An invoice scanner and assistant serve as your first line of defence against these errors. By capturing a digital link (an unbroken electronic chain from the original document to the final tax return), you satisfy HMRC’s requirements for digital record-keeping.

EazyCapture ensures that every VAT reclaim is backed by a high-resolution image of the original invoice, making audits a matter of a few clicks rather than a frantic search through physical files.

Why a Scanner is Actually Your New Assistant?

Many small business owners hesitate to adopt “automation” because they fear it will be complex or require them to change how they work. This is why EazyCapture positions itself not just as a tool, but as a bookkeeping and accounting assistant.

A traditional scanner simply takes a picture. An assistant understands what it is looking at.

For example, if you take a photo of a receipt from a petrol station, EazyCapture doesn’t just see text; it identifies the fuel cost, separates the VAT, and remembers that this should be categorised under “Travel” or “Vehicle Expenses.”

The Multi-Invoice Advantage

One of the biggest hurdles for small businesses is the sheer volume of small receipts.

Of course, this even includes coffee meetings, stationery, parking, and materials.

Scanning these one by one is tedious. EazyCapture’s Multi-Invoice Power Snap allows you to lay out several receipts on a table and capture them in a single photo.

The assistant then automatically crops, separates, and processes each one as an individual transaction. This turns an hour of scanning into sixty seconds of photography.

Solving the Accuracy and Fraud Dilemma

Manual data entry is inherently prone to “the human element.”

About 88% of manually keyed invoices contain at least one error. These errors often result in duplicate payments, missed VAT reclaims, or incorrect supplier payments—all of which directly impact your cash flow.

An automated assistant provides a level of precision that humans cannot maintain over long periods.

EazyCapture achieves over 99% accuracy in data extraction. It also acts as a security guard for your bank account.

Invoice fraud is a growing concern in the UK, with criminals sending “spoof” invoices with altered bank details. A digital assistant can flag when a regular supplier’s bank details have changed or when an invoice number has already been processed, preventing costly mistakes before the payment is ever authorised.

How to Implement An Invoice Scanner Without the Headache?

The final reason every small business needs an invoice scanner is that it has never been easier to start. Gone are the days of expensive desktop hardware and complex software installations.

The modern implementation of a bookkeeping assistant happens on your smartphone. To ensure security and compliance with UK financial standards, EazyCapture requires registration with a phone number.

This creates a secure, verified link to your account, ensuring that your sensitive financial data is protected.

Once registered, the onboarding process is designed for the non-technical user:

- Connect: Link EazyCapture to your existing accounting software (Xero, QuickBooks, Sage, etc.).

- Snap: Use your phone to photograph physical receipts or forward digital invoices to your dedicated EazyCapture email.

- Review: The assistant extracts the data, and you simply give it a quick “thumbs up” before it publishes to your ledger.

Reclaiming the Small Business Spirit

The spirit of small business is about innovation, service, and growth. It is not about data entry. By adopting an invoice scanner and an automated assistant, you are choosing to spend your time where it matters most.

The transition to digital is inevitable.

However, the move shouldn’t be driven by “fear of the taxman.” It should be driven by the desire for a more efficient, more profitable, and less stressful business.

EazyCapture offers that path – providing the tools of a high-end finance department to every sole trader, landlord, and small business owner in the UK.