Instead of AI threatening to replace accountants, it is augmenting their capabilities. Technology is reforming the accounting landscape.

One of the most promising developments is AI-driven validation of financial data.

This AI technology is poised to become the next billable service for accountants, turning what was once an internal task into a client-facing value proposition.

Progressive accountants in the UK and globally are discovering that AI-driven validation improves accuracy, saves time, and delivers greater value to clients.

Let’s talk about this in detail.

Key Takeaways

- AI augments accountants, increasing client capacity and accuracy.

- AI-driven validation automates error detection and compliance checks.

- Manual validation is inefficient and unsustainable for scaling firms.

- Firms can package AI validation as premium oversight or compliance services.

- Platforms like EazyCapture enable seamless invoice capture and intelligent validation.

The Evolving Role of AI in Accounting Services

Accounting firms are evolving to become strategic advisors, and AI in Accounting is accelerating this shift.

Far from taking jobs, AI is helping accountants manage more work with greater efficiency. It acts as an assistant that amplifies their productivity without replacing their expertise.

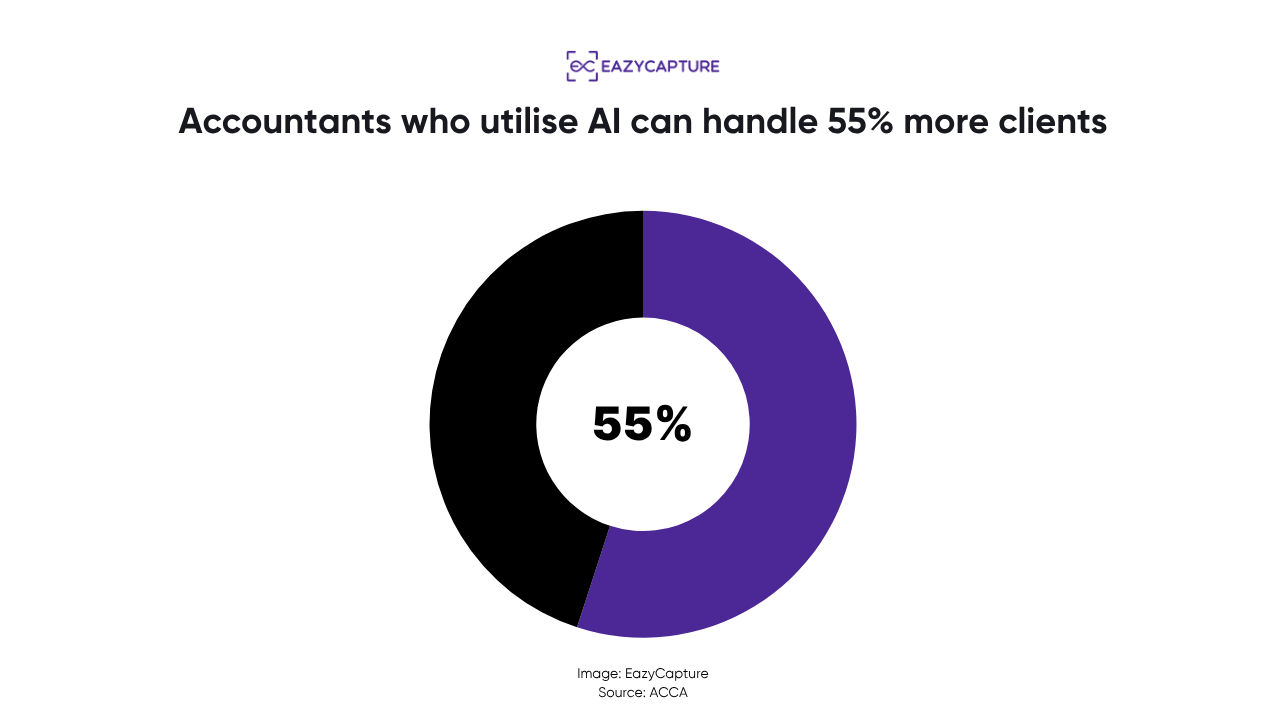

A recent Stanford study found that accountants who utilise AI can handle 55% more clients while also logging 21% more billable hours on higher-value work.

By automating tedious tasks like data entry, AI frees up ~3.5 hours per week for accountants, which gets reinvested into client communication, analysis, and quality assurance.

This dynamic is particularly evident in the UK’s accounting sector, which has been quick to adapt automation.

91% of UK accountants are either already using AI or planning to adopt it, primarily to upgrade productivity and accuracy. In fact, 46% of firms report using automation to streamline routine tasks like bookkeeping and invoice processing.

The motivation is clear: AI tools reduce manual workload and errors, allowing accountants to focus on advisory services and new revenue streams.

With more digital tax duties and fewer hands on deck, AI is the smartest path to scale. Accountants who adopt it position themselves as the go-to, innovation-driven advisers, with services that clearly set them apart.

Also Read: How To Use Automated Accounting In Your Business?

What is AI-Driven Validation in Accounting?

AI-driven validation in accounting refers to the use of intelligent software to automatically verify and cross-check financial information for accuracy, consistency, and compliance.

It is more than just traditional Optical Character Recognition (OCR). It combines OCR for data capture with machine learning for decision-making. The AI does not just extract data; it understands and checks the data.

Instead of relying solely on human reviews, AI systems can scan through documents, spreadsheets, or receipts to flag issues or confirm that everything matches up as it should.

In practice, AI-driven validation functions like a continuous quality check in the accounting workflow.

For instance, when processing a batch of supplier invoices, an AI validation tool will automatically flag any invoice where the totals do not add up, VAT is miscalculated, or the invoice number is a duplicate of a prior entry.

It performs a “three-way match” to make sure quantities, prices, and totals all align.

AI accounting platforms like EazyCapture can parse all kinds of financial documents, including PDFs, scanned receipts, and even handwritten invoices, extracting key details and validating them against rules or historical data.

Why do Accountants need to adopt AI-driven validation?

Manual validation is slow, costly, and error-prone. Guaranteeing the accuracy of financial records has been a laborious process. Accountants spend hours reconciling statements, checking invoices against purchase orders, and tracking down discrepancies.

Despite their diligence, humans are fallible.

Manual data entry and review carry a higher risk of mistakes, especially as transaction volumes grow. In comparisons of manual and AI-based methods, manual processes show a higher likelihood of errors, whereas AI-driven validation approaches near-zero error rates.

Beyond accuracy, manual processes do not scale well from a business profitability standpoint.

As businesses expand, the bookkeeping workload increases, but accountants can work only so many hours without compromising work–life balance.

This is a pressing issue in the UK, where regulatory changes such as Making Tax Digital require more frequent and detailed reporting.

As Accountancy Age notes, firms must shift “from annual clean-ups to continuous oversight” to meet real-time compliance needs. Continuous oversight is a heavy operational load: a firm with hundreds of clients faces thousands of submissions and cross-checks each year under MTD.

Chasing records and checking files is labour-intensive, and costs rise faster than revenue.

In this landscape, relying solely on manual validation is not just inefficient; it is unsustainable.

The impact on clients and firms can be severe. Errors that slip through lead to misstated financials, compliance penalties, and difficult conversations with clients. Delayed detection means issues are found at month-end or year-end, when fixes are more complex.

Every hour spent on low-level checking is an hour not spent on higher-value work, such as advising clients or planning growth.

Many accountants feel trapped in reactive fire-fighting of errors and exceptions rather than delivering proactive insight.

Manual validation is holding firms back at a time when clients expect more.

Impact of AI Validation for Accountants

AI-driven validation is moving from an optional add-on to a core capability in modern accounting. Its impact shows up across operations and client service. Here is what firms experience once it is switched on:

- Processing time dropped fast

Firms that switch on AI validation see invoice handling time drop by about 80 percent. Work that once took days is wrapped up in a few hours each week. The system spots issues in real time, so your team deals only with exceptions. As a result, clients’ payables are processed on schedule, strengthening relationships with their suppliers and with your firm. - Errors faded into the background

The AI raised more than a dozen issues in the first month. Duplicate invoices, transposed digits, and incorrect tax entries were caught before any money moved. Over a quarter, bookkeeping errors can fall by around 90 percent. Ledgers look cleaner, management reports become more reliable, and many financial controllers complete a quarter with no adjustments for the first time. - Cost savings and ROI

Less manual checking saves dozens of staff hours each quarter. Those hours shift to budgeting, analysis, and real client conversations.

The time saved often outweighs the software cost, while avoided mistakes add further value through prevented overpayments and accurate VAT recovery.

- Client peace of mind and trust

The most telling outcome is the qualitative feedback. Business owners report that AI-backed validation gives them peace of mind.

They no longer lose sleep wondering if their accounts contain small errors. This trust leads clients to involve the firm in more strategic discussions because the data is reliable and up to date.

In effect, the accountant moves from bookkeeper to trusted adviser. For the firm, this creates a stickier relationship and justifies higher fees tied to an expanded strategic role, not merely data entry.

These real-world impacts align with the push towards more efficient, error-free compliance. As regulators digitize reporting and clients expect more for less, AI-driven validation is arguably an essential component of today’s accounting services.

Bring AI validation to your firm with EazyCapture

AI-driven validation represents a rare opportunity in the accounting field. A technology that not only upgrades accuracy and efficiency but also opens the door to new services and revenue.

Instead of fearing that automation will cannibalise their work, smart accountants are realising it can amplify their value.

AI is transforming accounting by turning what was once a tedious chore into a selling point. The result is better quality financial data, faster turnarounds, and more bandwidth to serve clients in meaningful ways.

Accountant-focused platforms like EazyCapture connect you with best accounting software, including Xero, QuickBooks, Sage, etc. It offers out-of-the-box capabilities for invoice capture and validation.

Try EazyCapture now and make AI-driven validation your firm’s new revenue stream.