Artificial intelligence (AI) has moved from hype to hands‑on tools that accountants actually use: reading invoices, proposing postings, reconciling bank lines, flagging anomalies, and drafting explanations.

For UK practices and finance teams, the opportunity is real – but so are the regulatory and professional responsibilities that come with it.

This guide summarises what accountants in the UK need to know now: the use‑cases that work, the rules that matter, and a practical, compliant way to adopt AI in your firm or finance function.

Let’s get started.

The Evolution of Accounting Automation

Accounting automation has evolved in three waves:

- Spreadsheets & scripts – deterministic formulas, lookups and macros accelerated work but required clean inputs and manual checking.

- Workflow & rules engines – cloud ledgers, bank feeds, and if‑this‑then‑that rules reduced keystrokes across AP/AR, VAT, and close cycles, yet struggled with exceptions or novel formats.

- AI‑enabled systems – machine learning (ML) and natural‑language or computer‑vision models learn from historical data and user corrections. They infer patterns (e.g., vendor layouts or narrative descriptions), surface anomalies, and adapt as data changes.

Over time, model accuracy improves with feedback, and every “exception” becomes future training data – provided you log it with an audit trail.

Case studies compiled by ACCA show this shift across analytics, AP, and reconciliations.

Why AI matters for UK accountants?

First things first, Client, auditor and regulator expectations are rising.

The UK’s audit regulator has now issued its first guidance on AI in audit, emphasising proportionate documentation, explainability, and alignment to government AI principles.

That makes robust controls over data, models, and outputs a business requirement, not a “nice to have”.

In this case, precisely, the UK regulatory context matters.

HMRC’s Making Tax Digital (MTD) requires digital records and software‑based submissions for VAT, and staged adoption for Income Tax Self Assessment from April 2026 (£50k+) and April 2027 (£30k–£50k).

AI‑enabled process controls support these obligations and reduce rework at quarter‑ and year‑end.

Practical Use Cases

- Invoice Capture & Coding: Modern AI-powered bookkeeping assistants like EazyCapture combine optical character recognition (OCR) with ML to learn supplier layouts, extract header and line items, validate totals, and propose nominal codes, VAT treatments, and dimensions. This reduces manual entry, accelerates approvals, and improves the digital links required under MTD for VAT.

- Bank Reconciliation: ML models match transactions using multi‑feature similarity (amount, date ranges, payee strings, references) and learn practice‑specific heuristics. They flag outliers for review – e.g., unexpected counterparties, split payments, or weekend postings—speeding daily reconciliations and strengthening fraud controls before month‑end.

- Expense Validation & Compliance: AI screens expenses for duplicates, split claims, missing receipts, and out‑of‑policy items; it also reads narratives to detect potential breaches (e.g., gifts/hospitality). With appropriate prompts, GenAI can draft staff reminders that cite policy clauses, leaving partners to decide on exceptions.

- Forecasting & Advisory: Predictive models use receivables ageing, seasonality and customer behaviour to forecast cash collections and shortfalls. Scenario analysis can test “what if” plans (e.g., supplier price uplifts, FX moves, or debtor slippage) to guide working‑capital decisions for SMEs.

How AI Actually Works Inside Accounting Systems?

AI in accounting is built around three capabilities:

- Data recognition

- Pattern learning

- Decision support

Instead of relying on fixed rules (“If supplier name contains X, post to Y”), AI models learn from thousands of historical entries.

They detect contextual relationships between invoice fields, payment behaviours, and accounting codes – allowing them to predict where new transactions should go.

For example, an intelligent invoice reader like EazyCapture can:

- Extract supplier details, invoice numbers, and totals from PDFs or images using optical character recognition (OCR).

- Use machine learning to auto-classify expense categories based on historical data.

- Flag anomalies such as mismatched purchase orders or duplicate entries.

That’s more than time-saving. It establishes consistent, auditable data, which feeds directly into better reporting accuracy.

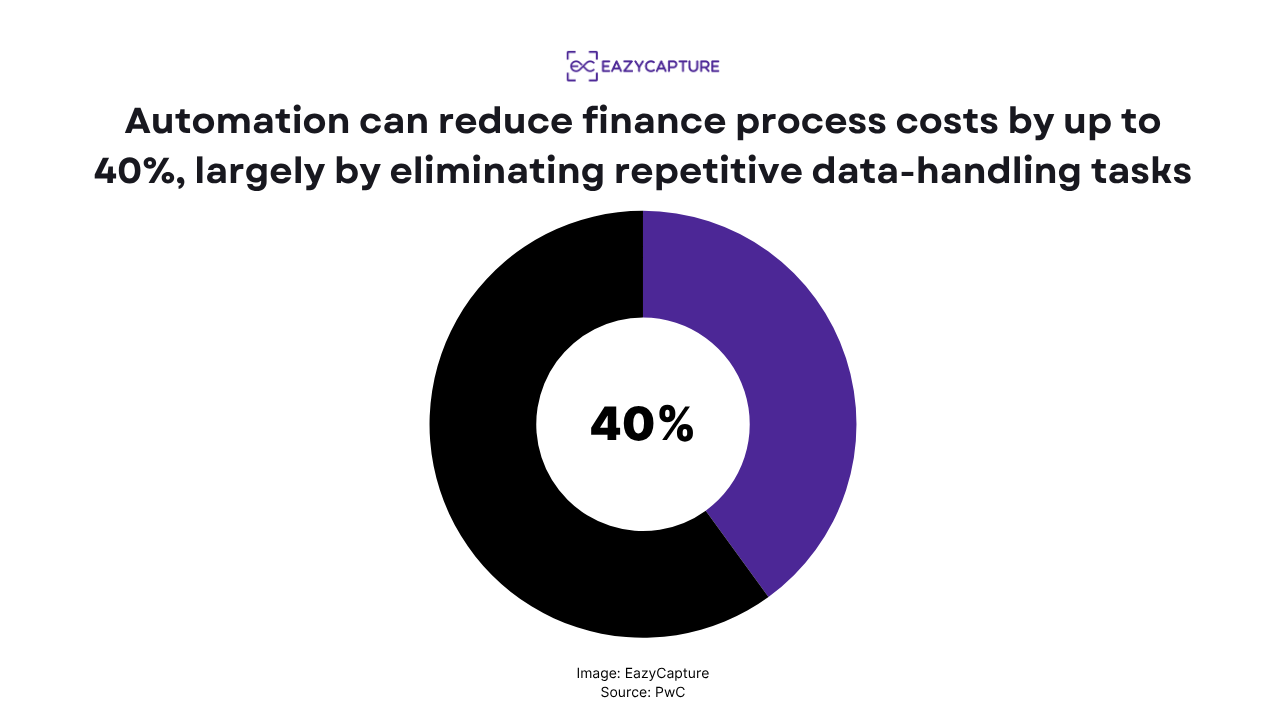

A PwC UK report (2024) estimates that automation and AI could save accountants up to 40% of their workload by 2030, mainly by removing manual data-handling tasks.

The shift is already visible in mid-sized firms that manage hundreds of supplier invoices weekly.

The UK Compliance Landscape: What Accountants Must Know

Unlike the EU, the UK hasn’t yet passed a dedicated AI Act.

Instead, it’s relying on existing frameworks such as UK GDPR, the Data Protection Act 2018, and sector regulators. For accountants, that means AI systems must meet the same data protection, audit, and fairness standards as any other financial process.

Here’s what it includes:

1. Data Protection and Lawful Use

The Information Commissioner’s Office (ICO) requires firms using AI to demonstrate:

- A lawful basis for data processing.

- Clear documentation of how data is collected and used.

- “Human-in-the-loop” oversight for any AI-driven decisions affecting individuals.

In practice, this means accountants should:

- Record where financial data is stored and processed (especially if it leaves the UK).

Document how AI-generated results are reviewed and approved before posting.

2. Audit Accountability

The Financial Reporting Council (FRC) has urged firms to measure not just how AI tools are deployed, but how they affect audit quality.

For internal finance teams, this translates into maintaining traceability – logs of when AI was used, what data it analysed, and how outputs were verified.

Without that, firms risk non-compliance with internal control standards and potential challenges from auditors.

3. Ethical and Bias Considerations

Although bias is often discussed in recruitment or credit scoring, it also applies in finance. AI systems trained on biased data can skew categorisation – for example, consistently misallocating vendor costs due to inconsistent training data.

Accountants must ensure AI outputs are reviewed and retrained regularly using diverse and representative datasets.

Choosing the Right AI Tools for Accounting

AI in accounting isn’t one-size-fits-all.

Before integrating new accounting software, UK firms should evaluate vendors on four essential criteria:

1. Accuracy and Transparency

Ask vendors how accuracy is measured and validated. Look for benchmark data – for example, accuracy rates of >90% for invoice capture or field extraction, verified by independent audits.

2. Data Residency and Security

Under UK GDPR, financial data processed through AI must comply with local data transfer rules. Ensure the vendor’s servers are UK- or EU-based, and request SOC 2 or ISO 27001 certification for security assurance.

3. Explainability

Accountants need to justify results. Choose systems that provide explainable AI (XAI) – meaning you can see why the system made a particular recommendation or coding decision. This feature is crucial for maintaining auditability.

4. Integration and Compatibility

AI works best when embedded in your existing ecosystem – cloud accounting software like Xero, Sage, or QuickBooks. A platform like EazyCapture fits this model by connecting document intake directly with accounting entries, without adding another isolated workflow.

Preparing the Team: Building AI Readiness in Accounting Firms

AI adoption isn’t just a technology upgrade – it’s a skills transformation.

Accountants who used to spend hours reconciling invoices now need to interpret AI outputs, manage exceptions, and evaluate trends.

Upskilling Priorities

- Data literacy: Understanding how models process and classify transactions.

- Prompting and validation: Knowing how to review, question, and adjust AI results.

- Ethical awareness: Recognising when automation crosses compliance boundaries.

According to ACCA’s 2024 global report, only 31% of accounting organisations have formal AI training programs.

That leaves a wide gap (and an opportunity) for forward-thinking firms to position their teams as AI-literate advisors, not just bookkeepers.

A Realistic Roadmap For UK Firms

Implementing AI successfully requires structure. Here’s a four-phase roadmap tailored to UK accounting practices:

1. Identify High-Volume, Rule-Based Processes

Start with tasks where human input adds little judgment – invoice entry, expense approvals, or bank reconciliations. Use time-tracking data to identify where staff hours are most consumed.

2. Run Controlled Pilots

Select one process, set measurable KPIs (time saved, accuracy rate, error reduction), and limit the pilot to a defined time window. Document results and learnings – these form the basis for scaling responsibly.

3. Build Governance Early

Establish written policies for:

- AI data use and retention

- Human review thresholds

- Accuracy testing and retraining intervals

These documents show regulators and auditors that AI is managed with professional discipline.

4. Communicate and Integrate

Loop in auditors, clients, and team members. Explain what AI is doing, what it isn’t, and how oversight works. Transparency builds trust – a currency more valuable than automation itself.

Also Read: How AI is Transforming Accounting: A Detailed Review

The Bottom Line

AI will not replace accountants; it will elevate them into interpreters of financial data-professionals who combine domain expertise, controls, and context with machine‑scale processing.

The regulatory direction is clear: document what the system did, why it was appropriate, and how a human oversaw the outcome.

Firms that adopt AI responsibly will deliver faster reporting, tighter audit readiness, and better advice.

And platforms like EazyCapture are built precisely for that intersection: intelligent document automation that respects UK compliance standards while freeing accountants to do what they do best – advise, interpret, and lead.

Try EazyCapture now.