AI isn’t a new concept for accounting.

However, most accountants are still clueless (if not uncertain) about how to leverage AI effectively in their domain.

Most articles treat AI as a magic button that “automates bookkeeping.” It isn’t.

It’s a structured set of models, algorithms, and feedback systems that remove repetitive work, reduce human error, and create cleaner data for better decisions.

This guide breaks it down. In plain language, with technical precision.

Why The Phrase “AI for Accountants” Is Misunderstood?

First things first, automation ≠ AI.

Not by a long shot.

Uploading a CSV into QuickBooks is not ‘intelligence’. And auto-filling a form isn’t learning.

True AI systems behave differently – they analyse patterns, learn from feedback, and adjust their predictions over time.

That’s the leap modern tools are making. Instead of forcing accountants to code every rule manually, machine learning models observe behaviour: how invoices are categorised, how VAT is applied, and which suppliers require approvals. Then they begin predicting those steps automatically.

The result is speed and consistency where every transaction is processed under the same logic, every time.

The UK Context Behind Accounting

The UK accounting infrastructure adds its own complexity:

- Making Tax Digital (MTD) requires digital record-keeping and submission.

- VAT compliance depends on correct categorisation and evidence retention.

- Audit readiness demands traceability from entry to source document.

AI fits perfectly here because it thrives on structured, repeatable processes.

Every step – invoice capture, categorisation, VAT tagging, audit trail – can be handled or verified by machine learning systems.

When those systems are connected to Xero or QuickBooks, the data doesn’t just move faster; it stays compliant by design.

The Four Layers of AI in Accounting

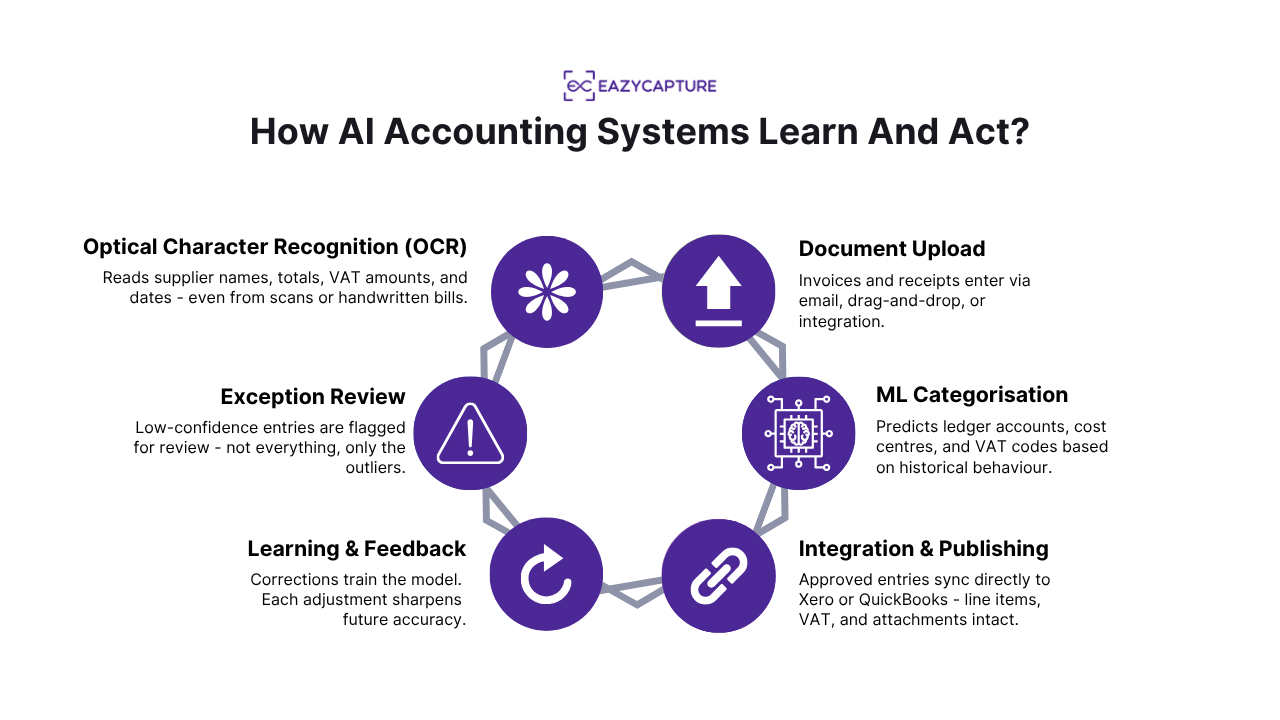

1. Optical Character Recognition (OCR) - the Eyes

OCR converts unstructured data (PDFs, images, scans) into machine-readable text.

Think of it as the eyes of the system.

Modern OCR models don’t just read text; they understand context, knowing that “£1,200 VAT @20 %” isn’t just a number, but a tax calculation that must be mapped to a ledger field.

This layer handles invoice numbers, supplier names, dates, line items, and totals. Without accurate OCR, everything downstream collapses.

2. Machine Learning Models - the Brain

Once the text is captured, machine learning models classify it.

They use past data to predict how new transactions should be coded.

For example, if ten past invoices from Royal Mail were posted to Utilities, the system will automatically predict the same category for the eleventh — unless it detects an anomaly.

This is adaptive logic.

Each correction you make becomes a new data point, improving future accuracy.

Over time, exception rates shrink dramatically – from 15 % in the first month to under 5% once the model matures.

3. Workflow Logic — the Hands

AI isn’t useful without process.

Workflow logic connects intelligence to action: approvals, posting rules, and routing.

For instance, if an invoice exceeds £5,000 or comes from a new supplier, the system can route it to a senior reviewer automatically.

This layer enforces internal controls while keeping everything moving. No one needs to remember approval chains; the logic executes them.

4. Feedback Loop — the Memory

Every correction, override, or approval teaches the model.

That’s how the system grows smarter. If a user changes an expense category from “Office Supplies” to “Marketing,” the AI updates its internal weightings.

Next time a similar invoice appears, it predicts the correct category immediately.

This feedback loop is where real learning happens – and where EazyCapture, one of the leading UK-ready tools, excels.

It closes the gap between automation and intelligence.

Document to Ledger: How the Flow Actually Works?

Here’s the typical journey of a transaction inside an AI-driven accounting workflow.

- Document Upload – The accountant (or client) emails or drags invoices into the system.

- OCR Extraction – The model reads supplier names, invoice numbers, totals, and VAT.

- Machine Learning Categorisation – Based on historical behaviour, it predicts ledger accounts and tax codes.

- Exception Review – Anything with low confidence is flagged for human review.

- Workflow Logic & Approval – Rules route specific invoices to reviewers or departments.

- Publishing – Approved transactions sync to Xero or QuickBooks with full details and attachments.

- Feedback Storage – Every action (approve, edit, reject) updates the model’s learning dataset.

Each stage replaces manual input with structured logic – yet remains fully auditable.

Applications in Real UK Accounting Workflows

Evidently so, AI refines traditional accounting.

In UK firms, where VAT, MTD, and audit standards leave zero room for error, AI tools are essential infrastructure.

This part looks at how modern accounting AI works in practice, where it adds precision, and how AI bookkeeping tools like EazyCapture embed that intelligence end-to-end.

1. Invoice Capture and VAT Handling

The UK’s VAT landscape is complicated with its multiple rates, partial exemptions, and strict digital-record requirements. Manual entry leaves too much room for inconsistency.

AI simplifies that chaos.

When a supplier invoice lands, OCR immediately extracts totals, dates, and line-item details. Machine-learning logic then assigns VAT codes based on historical behaviour, supplier type, and transaction context.

If an invoice contains mixed rates, say 20% for materials and 5% for utilities, the model splits them automatically. It even flags anomalies, such as a zero-rated item where there shouldn’t be one.

For MTD compliance, that’s crucial.

Every line becomes traceable, every VAT amount fully auditable.

When you can show that the VAT logic was machine-derived, verified, and documented, HMRC audits become verification exercises, not panic events.

2. Categorisation and Reconciliation

Categorisation is where many firms lose hours – mis-tagged suppliers, duplicated entries, or inconsistent chart-of-accounts mapping.

AI fixes this quietly but powerfully.

On the bank side, reconciliation moves from manual to predictive.

When a payment matches an open invoice within a tolerance, the system clears it automatically.

And if there’s a mismatch, it’s highlighted for human review.

3. Predictive Error Spotting and Anomaly Detection

The most advanced systems don’t just record history. They anticipate mistakes before they settle in the books.

Machine-learning algorithms can flag anomalies like:

- supplier invoices arriving twice with identical totals;

- expenses logged under unfamiliar categories;

- sudden spikes in a recurring vendor’s charges.

These models are trained to detect deviation from normal patterns, much like fraud-detection systems in banking. For UK firms managing dozens of clients, that means errors surface before month-end, not after.

Where EazyCapture Fits Into Each Stage?

EazyCapture is one of the few tools that connects every link of this AI chain.

- In invoice capture, it supports multi-page PDFs and even handwriting recognition, which is ideal for clients who still send scans.

- During categorisation, its machine-learning model improves continuously from user corrections, meaning exception rates shrink over time.

- For VAT handling, it extracts detailed VAT lines and exports MTD-ready data formats.

- In reconciliation, its integration with Xero and QuickBooks ensures entries carry attachments, currency data, and tax logic without breaking audit trails.

- And its feedback loop turns every manual fix into training data, tightening prediction accuracy with each iteration.

It’s not automation stitched together; it’s intelligence built into the workflow.

Why EazyCapture Is The Right Fit For You?

- Most AI tools stop after extraction.

- EazyCapture integrates every layer.

- Its OCR engine handles multi-page and handwritten invoices. Its ML model improves categorisation accuracy with each correction.

- Its workflow engine routes approvals and exceptions intelligently.

- And its direct integrations push approved entries – complete with attachments and VAT lines – into Xero and QuickBooks automatically.

That makes it a full-cycle AI platform, not a partial accounting automation layer. For UK accountants, it means faster closes, fewer errors, and effortless MTD compliance.

The goal isn’t to eliminate accountants. It’s to eliminate noise.

When machines handle the repeatable 80%, accountants can focus on analysis, forecasting, and client strategy.

The firms that embrace this mindset early will redefine efficiency and accuracy in UK accounting. Those that don’t will soon look outdated.

Also Read: How AI is Transforming Accounting?

What Accountants Should Monitor?

Even the smartest models need oversight. Here’s what expert firms track:

- Accuracy trend: exception rates over time — should fall steadily.

- Audit integrity: that attachments and VAT evidence remain linked.

- Workflow transparency: who reviewed what, when, and why — all visible in logs.

- Regulatory updates: ensuring models stay aligned with the latest HMRC VAT or MTD requirements.

As models evolve, they’ll move from recognising patterns to predicting intent: spotting fraud indicators, cash-flow pressure, or even client-specific behaviour changes before humans notice.

For UK firms, this means less time spent typing numbers and more time guiding clients with insight.

Your job shifts from “recording what happened” to “interpreting what’s about to.”

EazyCapture and similar systems are already laying that groundwork.

And if you want a similar streamlining for your business, start with EazyCapture today.